Photo Copyright: adamr / 123RF Stock Photo

Seeing the light at the end of the tunnel?

Greetings Fellow Baby Boomers! It is interesting as we near or actually reach the age of retirement how we start to see the “Light at the end of the tunnel.” Perhaps it is because we get more and more fed up with the politics at the office, or worse yet having been through one or more “buy-outs” where we have seen our pension programs get watered down or just out and out decimated (it happened to me personally, twice). Whatever YOUR reason for looking for the light at the end of the tunnel, If you are at all like me You are about the discover that the “light at the end of the tunnel” is not the end of the tunnel, but rather the freight train that is headed full throttle directly at you! That freight train is bringing retirement issues that are about to slam into YOU with the full force of a speeding locomotive!

So if you are currently working and you have not yet reached the point of retirement you may be VERY unaware of just how quickly it can hit you and how ill prepared you may be with respect to being able to maintain your quality of lifestyle as you are currently enjoying it! So you mihgt say to me, “Larry, I’ve been really working to catch up using all of the tax strategies available and I am making great progress at getting on track to be able to have a nice retirement.” So what if You are say 63 or 64 and all of a sudden your company decides to down-size? You know how are usually the first to be trimmed down don’t you? Right, the most senior people! It should not take you by surprise either. Think about it… You are most likely the more expensive resources that your company employs. Add to that you may possibly be conceived as not being nearly as flexible or for that matter as up to date with current methods of operations as the younger guys that are in their 20’s and 30’s. Granted they don’t have nearly as much experience as YOU do, but then, when push comes to shove, management is always going to look at how they can get the biggest cost reduction with the smallest amount of impact on day to day operations. Unfortunately, that usually means eliminating the most senior, most costly employees and that means YOU! You may think that you are a most valuable member of the team and that you would be one of the last to be let go, but in fact, the odds are against you!

I felt that way too. Just like you! I was working hard to catch up on my retirement programs and i had even started working to build an alternate stream of income outside of my work and in a totally different field from what I was doing. In fact I was away on vacation so that I could attend a conference for my secondary income stream, when I got called by my boos so that he could tell me that I was being laid off! The company’s need to shed costs was so drastic that they could not even wait 4 days until I got back from vacation to tell me that I was going to be laid off!

Let me tell you this, it can happen to you too!

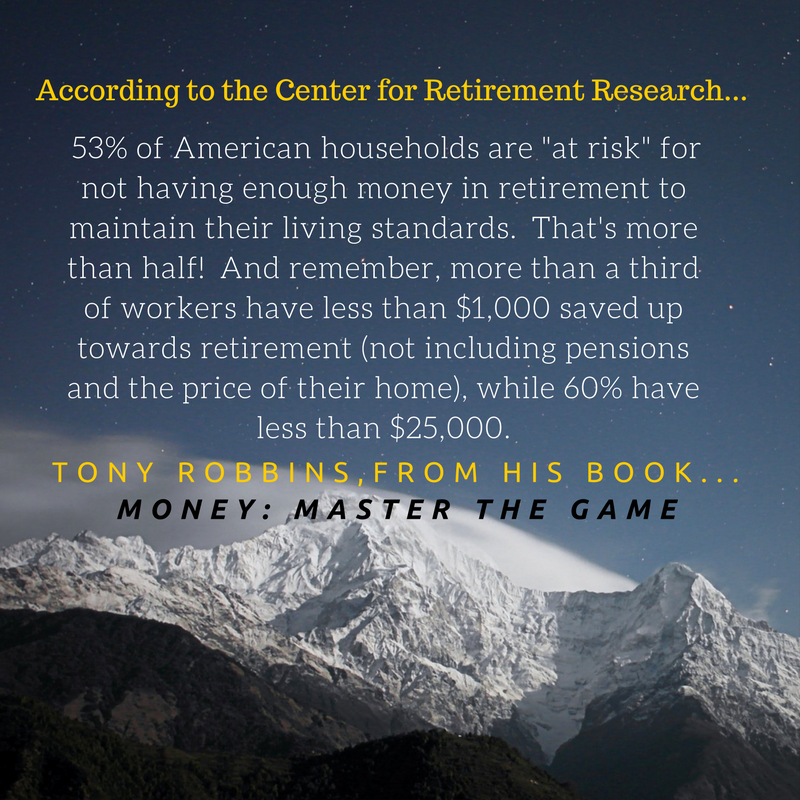

So here is what happened subsequent to that. My wife was also nearing retirement from her job and we decided that perhaps it was time for me to retire and that a year later she too would retire. I had my 401K’s and of course my Social Security as well. We decided to put off my collecting from Social Security for at least a year or more and for me to collect “Spousal benefits” from my wife’s Social Security. That with her income was enough for us to do okay. But then after she retired and we started claiming her Social Security benefits, is when the reality of how ill prepared we actually were for a long term retirement. The reality that when I thought that I was seeing the end of the tunnel approaching I did not realize that it was in actuality the freight train heading in my direction! So my fellow Baby Boomers, let me give You a fair warning that Unless you are one of the few exceptions You are most likely not very well prepared either! Don’t take my word for it however. Check out what Tony Robbins has to say about this in his book Money: Master the game

I am glad that I was in better shape than those that Tony referenced in that study, but I was even more glad that I had begun to establish a secondary source of income that would become the real source of my lifestyle in retirement. It will be what allows me to travel to the places my wife and I want to visit as well as being able to just enjoy life on our terms!

My next few blog posts will cover some of the issues that are raised on television these days and showing you how to “Fix” your own retirement, but more importantly some of the things that they don’t want you to think about! I am going to raise some important questions that YOU need to contemplate as you consider and prepare for your retirement! I am also going to show You alternative ways that you can use to augment or better yet replace your income. Showing you how YOU can actually create passive income. The upcoming video blogs that I will be releasing over the next few days will require abot 20 to 30 minutes over the xext few days, but that time will be a great investment in YOUR future and can have a dramatic impact upon YOUR ENTIRE RETIREMENT! You won’t want to miss the rest of this series!

So please do yourself a favor and make sure You sign up below to receive my future blog posts!

Make it a great Day!

Larry Coates